Assets : 30 billion

Location : Hong Kong

Stock investment strategy :

Introduction of works

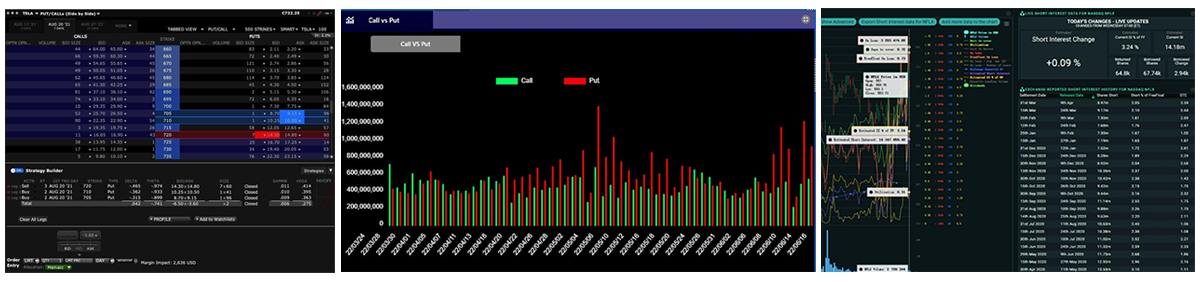

HS is one of the first companies to use the third generation of quantitative trading technology, focusing on artificial intelligence and quantitative trading as the core operation. It allows more ordinary investors to test their ideas in practice through its historical backtesting strategy without incurring losses. It has hundreds of investment strategies, thousands of investment factors, and many complex algorithms embedded in the bottom logic, so that the success rate is far higher than that of individual investors, and the first and second generation of quantitative investment institutions.

Research team

HS is a team of world-class excellent investment researchers, most of which graduated from world renowned Universities like The University of Warwick, Stanford University, St. Louis University in Washington, University of California, Boston University and so on. Majoring in finance and mathematics. Our key investment decision makers have decades of experience in US, Hong Kong and many other stock markets. Some have worked on both small and large scale investment firms such as Morgan Stanley, Bridge water and Blackstone. Some of our experts have written well-known research books and literature in the field of finance, which are regarded as industry’s standards in some fields. Our elite team of professionals has accurately judged the trend and inflection point of the major global markets several times and predicted the economic crisis and inflection point, and has a good record in the industry segmentation and individual stock research sectors, to earn huge profits and returns for customers.

The data of all individual stocks in the current market are backtested and screened through the world's leading quantitative trading artificial intelligence big data, and then the screening results are handed to our senior investment research team for manual correction, and a signal with “high success rate” is finally obtained.